Source: Wood Mackenzie

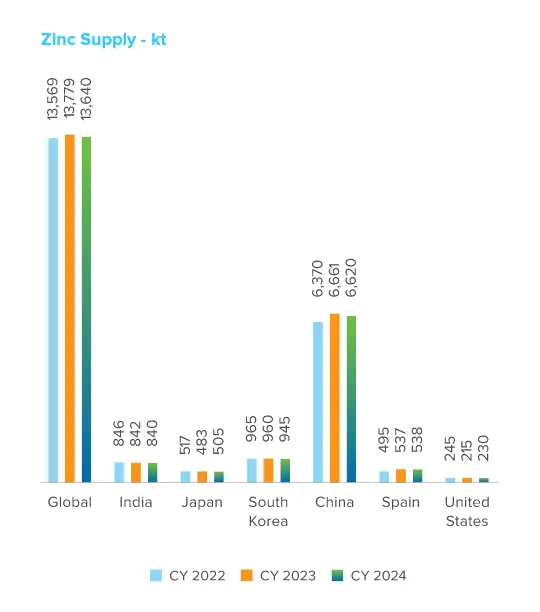

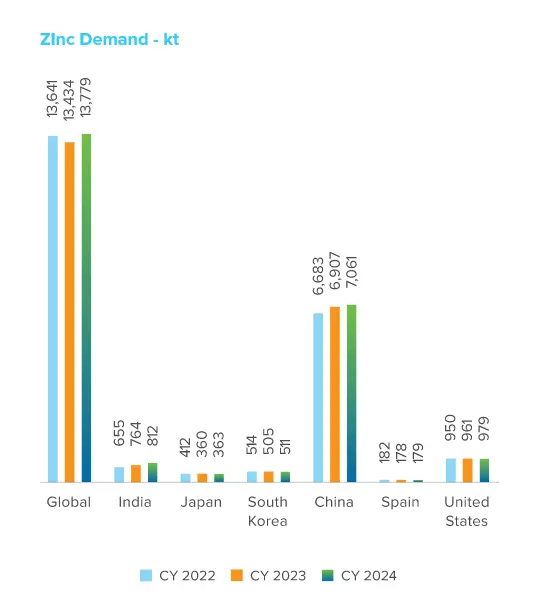

In CY 2023, zinc price lost its shine as macro headwinds deterred investor sentiment, and unsustainable metal surpluses accumulated. Zinc LME ended FY 2023-24 at US$ 2,391 per tonne, 17.8% lower than the figure for March 31, 2023. At supply level, refined zinc production increased by 1.5% to 13.8 Mt in CY 2023. The global refined zinc demand contracted by 1.5% to 13.4 Mt in CY 2023, largely due to a fall in Chinese, USA and EU regions. Supply, however, went up, creating a surplus in the market. This resulted in an increase in the warehouse (LME & SHFE) stocks by 386% (50 kt to 243 kt), and consequent pressure on metal premiums on a spot basis.

The removal of COVID restrictions was expected to lead to a strong rebound in the Chinese economy and zinc demand in CY 2023. However, the structural slump in the real estate industry and the exceptionally low levels of confidence among consumers and businesses continued to impact recovery. Consequently, the combination of government-backed stimulus programmes and strong export demand for Chinese-made galvanised sheets, white goods and automobiles drove zinc consumption in CY 2023.

In Europe, the demand situation continued to be a matter of concern. The continent's zinc consumption has undergone a structural shift due to permanent capacity closures caused by rising energy prices, even though there has been a subsequent decline in the prices. This is especially the case in Germany, where the effects of increasing energy costs have been most pronounced. The US economy went through a demand slump in CY 2023 on account of rising interest rates, growing unemployment, and other macroeconomic factors.

In terms of demand, India has surpassed the globe. The Indian economic environment has remained optimistic. The same was reflected in the S&P Global Manufacturing PMI, which stood at 59.1 in March 2024 as compared to 56.4 in March 2023, reflecting expansion in the manufacturing sector. This highlighted 31 successive monthly improvements in operating conditions. India’s manufacturing PMI numbers have reflected strong economic growth, which has translated into increased demand for goods. In CY 2023, India became the top country in terms of percentage increase in steel production. The domestic production of finished steel went up by 2.7% to 138.8 Mt from April 2023 to April 2024 (P). Consumption in the domestic market during the same period stood at 136.3 Mt, up by 13.6%. The total net finished steel exports till March 2024 stood at 7.5 Mt, up by 11.5%.

India’s largest and the only primary zinc producer, Hindustan Zinc commanded a primary market share of 75% in FY 2023-24, selling 580 kt zinc, which was 20% higher than FY 2022-23. It also sold 161 kt of Value-Added Products (VAP) during the year, which is historically the highest. Hindustan Zinc’s domestic sales were aligned with the growth of the Indian primary zinc market, rising 20% y-o-y with historically highest domestic sales and an increase in the VAP portfolio from 15% to 20%. About 71% of the refined zinc produced by the Company is sold in the domestic market, and the rest is exported to the SAARC, South-East Asia, Middle East, US and Europe regions.

In CY 2024, global refined zinc production is expected to decrease by 1% to 13.6 Mt, and global consumption is likely to increase by 2.6% to 13.8 Mt. Zinc and the world economy are both impacted by the emerging consensus in the US that interest rates have peaked, and that the US Federal Reserve will begin to reduce the interest rates. The most recent US inflation data, and growing tensions in the Middle East, however, make it difficult to predict when the interest rates will be reduced. The lowering of interest rates, when it happens, will make investors more willing to take on risks, which would raise the price of commodities. Additionally, zinc prices are likely to remain volatile, though not to the same extent as in the last two years.

Despite these challenges, India continues to perform better and sentiments tend to be positive. India’s broad-based prosperity has persisted, with notable metal-intensive industries like construction, electricity, and automotive generating remarkable growth rates. In FY 2024-25, the Indian zinc market is expected to grow by 5.2% to 810 kt, on account of urbanisation, increase in disposable income, and the government’s focus on infrastructural growth.