FY 2023-24 was a year of renewed vigour and dynamic growth for Hindustan Zinc. It was a year of effectively leveraging our strengths to respond efficaciously to the transformations and challenges in the industry and the market. In a volatile external environment marked by plunging metal prices, we delivered solid growth. We sustained our EBITDA margins at 47% by successfully navigating various obstacles through our targeted initiatives and game-changing innovations. Our concerted efforts to drive operational efficiencies and cost optimisation yielded exceptional results. They enabled the Company to maintain its industry-leading position while staying on track with its growth and expansion plans across its business segments.

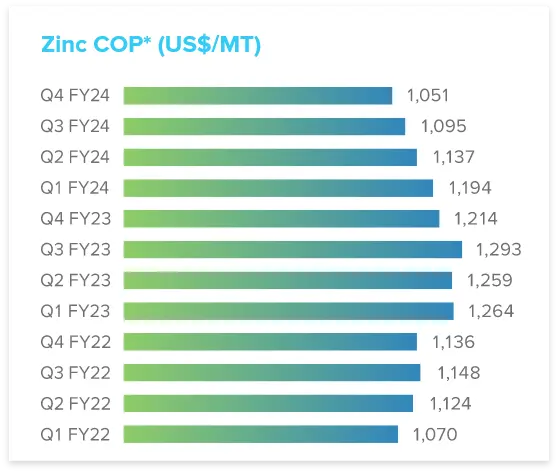

It gives me immense pleasure to share that we delivered the highest ever production levels during the year in terms of mined metal, refined metal and silver. We successfully achieved cost better than the lower band of FY 2023-24 annual guidance of US$ 1,125-1,175/MT, with a full year COP of US$ 1,117/MT. This has put Hindustan Zinc in the first decile of the global zinc mines cost curve and in the first quartile of the global zinc smelters cost curve – a remarkable achievement which we shall strive to improve further.

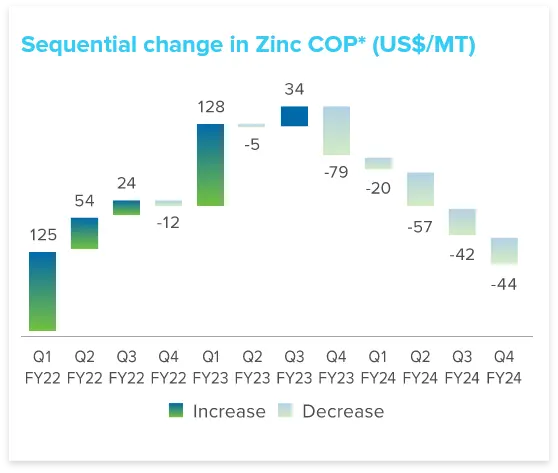

*COP without royalty

The sustained cost reduction we achieved over five consecutive quarters with a cumulative improvement of c.US$ 240/MT, was driven by a host of factors, some of which are listed below:

Our efforts during the year remained focussed on maintaining a strong liquidity position and healthy free cash flow from operations. Our investment in high-quality debt instruments was a key enabler of these efforts, which were endorsed by the consistent AAA rating for the Company by CRISIL Ratings Limited.

I would like to underline here that our strategic focus on improving operational and cost efficiencies helped Hindustan Zinc to withstand the market headwinds during the year. It ensured the preservation of margins and shareholder value, while strengthening our resilience and fortitude.

Our enhanced global resources and reserves was another notable metric of our robust performance in FY 2023-24. At current mining rates, our R&R underpins metal production of more than 25 years. In the last five years, the R&R has increased by 35% (incremental ore of 118 Mt) considering production of 65.1 Mt of ore in this period, which gives us a strong edge in the global mining industry.

We also continued our focus on resource-to-reserve conversion, leading to an increase in the total ore reserves. We have strategically incorporated ‘Hindmetal Exploration Services Private Limited’ as a wholly-owned subsidiary to explore, discover, develop and tap mineral resources, aligning with the Indian government’s focus and vision. This decision is aligned with our strategy to ensure long-term reserves for sustained business growth and value creation.

During the year, we made a conscious decision to maximise our silver production to harness the increasing demand potential and the soaring silver prices. This was in line with our strategic focus on investing in the right levers of growth and the Government of India’s ‘Atmanirbhar Bharat’ campaign.

Given the pace at which the solar RE transition is taking place, we see the demand for silver going up exponentially in the coming years. Additionally, the proliferation of electrical appliances, electronics and gadgets has also catalysed silver demand, as silver finds use in conductive materials and components owing to its exceptional conductivity. Demand for silverware and silver jewellery in India is also on the uptick, driven by the country’s robust economic growth and rising disposable incomes.

Hindustan Zinc is positioned in the sweet spot to make the most of this growth potential, as validated by our 5% year-on-year production growth and our leadership status as a key player in the global silver market. Innovative technologies and sustainable mining practices will continue to help us in optimising the silver production process while minimising its environmental impact.

At Hindustan Zinc, we have placed sustainability at the centre of our business model and built our ESG strategy on the foundation of economic prudence. This helps us to ensure that our initiatives deliver both positive societal impact and robust financial performance.

Our renewable energy power delivery agreement (PDA) for 450 MW provides us better cost visibility as the procurement is at a fixed rate in dollar terms for 25 years, insulating us from any interest rate and exchange rate fluctuations. We have initiated the deployment of battery-electric vehicles in our underground mining operations and electric vehicle (EV) trucks to pioneer sustainable logistics in the mining industry. This will also lead to a remarkable decline in the ventilation requirements in the underground mines, facilitating further expansion while reducing ventilation costs. These initiatives with economic prudence will also help in maintaining our cost leadership position globally.

At Hindustan Zinc, transformation is a way of life, encompassing all its key functions. The Finance function has also witnessed several game-changing transformations including use of analytics and data to drive continuous efficiencies through agile decision-making and to improve transparency in reporting. As a testament to this transparency and our ethical tax practices, we were honoured with the prestigious Tax Transparency Award at the 7th Tax Strategy & Planning Summit & Awards.

To highlight a few significant digital transformations in the Finance function, the migration of our enterprise resource planning to SAP RISE cloud platform and end-to-end automation across the verticals of our treasury processes have ensured highest standards of governance in the Company and were recognised with the Digital Transformation Project of the Year award at the 7th edition of Business World CFO Finance & Strategy awards under the gold category.

Effective finance business partnership is also helping us to strengthen our decision-making, enabling us to create value by offering insights beyond conventional practices that influence business counterparts. This facilitates us to make better decisions, and to align our financial goals with the broader strategic objectives, safeguarding the organisation’s financial health and driving its sustainable growth.

We strongly believe that our inherent strengths, coupled with our dynamic agility, will continue to propel the Company’s long-term growth and value creation journey. At the same time, we are cognisant of the various business risks that have the potential to derail our growth plans and impact our profitability. We are mindful of the importance of effectively managing these risks on time. Fluctuations in commodity prices and supply constraints, as well as adverse changes in LME and LBMA, can potentially affect our business plans and we have put in place strong hedging and business partner (BP) systems to prevent any serious impacts of these on the Company.

I would like to assure you that Hindustan Zinc remains committed to prioritising your interests, and those of its other stakeholders, in all its decisions and actions. Our focus on scaling our cost optimisation and operational excellence efforts will continue to steer our sustained value creation odyssey and keep Hindustan Zinc ahead of the curve not just in terms of business performance but in partnering the nation in its net-zero journey. Our responsive and responsible approach, and our strong focus on sustainable and innovation-led growth, will drive Hindustan Zinc towards bigger accomplishments, going forward.

Regards

The Company has provided me with mentorship, training, and ample opportunities for advancement, a testament to which is that I have been recognised as ‘The Great Manager’ by People Business Consulting & The Economics Times. What sets Hindustan Zinc apart from other organisations is its unwavering commitment to promoting diversity, equity, and inclusion without discriminating age, gender, or demographics, giving opportunities to deserving candidates thereby contributing to the economy as a whole.

The work culture at Hindustan Zinc is nurturing and provides a highly conducive environment for learning, growth, and prosperity. Being selected as an emerging women leader inspires me, challenges me, and pushes me into different areas, allowing me to invest my time, knowledge, and experience in a company that is investing in me.

During my time at Hindustan Zinc, I have received invaluable guidance and mentorship from senior leadership, inspiring me to excel in my Treasury role. Additionally, the Company introduced an innovative Progressive Parenthood Policy, highlighting its commitment to employee well-being.

I am associated with Hindustan Zinc from 4.5 years, leading as Unit Finance Head of the world’s largest underground zinc mines through Emerging Women Leadership program. It has empowered me to make strategic financial decisions, engage stakeholders effectively, and manage budgets crucial to our success. I am proud to be part of the Hindustan Zinc team, driving excellence in the mining industry.