Mine Life (R&R) at current rate of metal production

Reserves & Resources

Refined metal production

Mined metal production

Silver production

Capex utilised in FY 2023-24

Zinc COP; first decile of the global zinc mining cost curve and first quartile of the global zinc smelting cost curve

3-year average EBITDA margin

ROCE; led by resilient capital management strategies

Product excellence

Geographically diversified

Service orientation

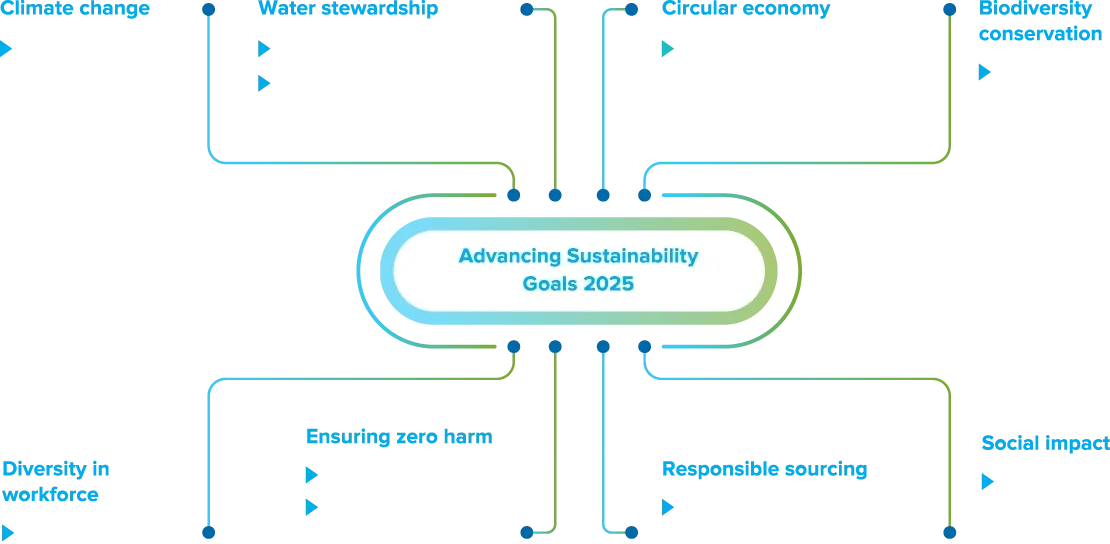

We strive for ESG excellence and undertake industry-defining initiatives to significantly reduce our environmental footprint, ensure the highest levels of safety and good governance and empower our communities. Aiming for decarbonisation, we have a robust RE portfolio capacity of 362.7 MW (solar, wind and waste heat recovery boiler) and another 450 MW of long-term RE Power Delivery Agreement.

The Company’s recycling business underscores its strategic focus on circular economy and waste utilisation, enabling better metal recovery and improved economic opportunities from the existing waste streams. We are focussed on exploring further opportunities in the recycling space, including extraction of metals from industrial residue and electronic waste.

Lives benefitted across 3,685 villages from sustained CSR initiatives

Global recognitions in ESG

In metal & mining industry in S&P Global Corporate Sustainability Assessment 2023

In climate change and water security by CDP

Member

Disciplined capital management

Operational excellence

5-year average dividend pay-out

Net worth

5-year average cash flow from operations