Source: Wood Mackenzie

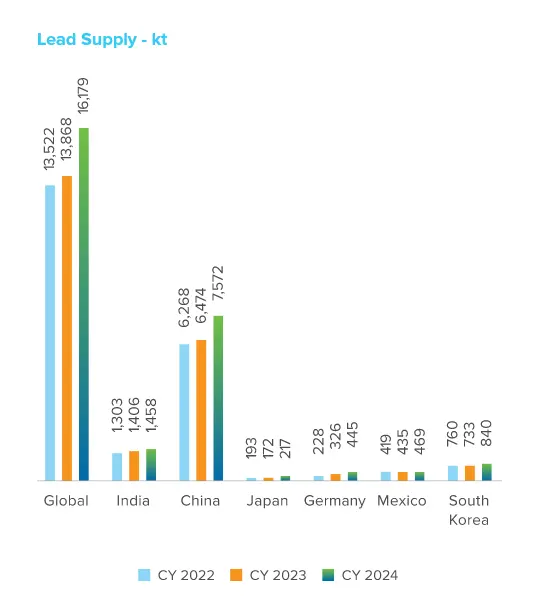

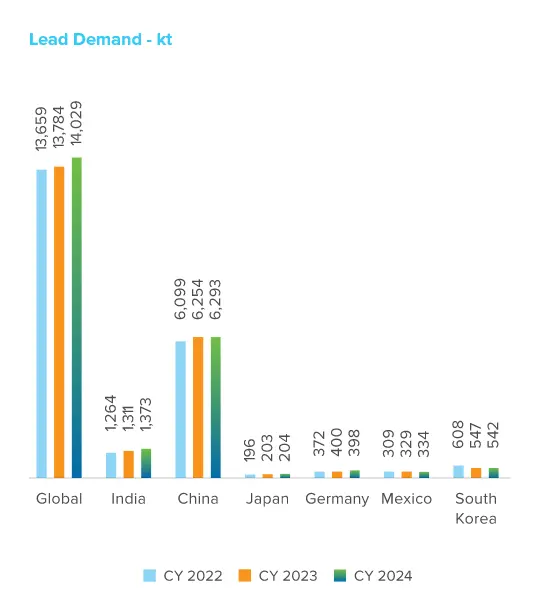

The lead LME ended FY 2023-24 at US$ 1,965 per tonne, which is 8.4% lower than the March 31, 2023 figure. High inflation and rising interest rates have impacted the demand for consumer and capital goods in developed economies (especially in USA, EU and China). Subdued demand growth created a market imbalance between mined and refined output and demand, leading to unsustainable metal surpluses and subsequent fall in prices. Additionally, lower PMI numbers in Japan, US, Eurozone and South Korea suggested a struggling economy during this period. At supply level, the refined lead production increased by 3% to 13.9 MT in CY 2023. Global refined lead demand increased by c.0.7% to 13.8 Mt in this period, largely due to the macroeconomic situation across the globe. Additionally, countries are moving towards green energy, driving replacement with substitutes of lead batteries.

Indian primary lead demand in FY 2023-24 remained around 198 kt. In contrast to the 0.4% increase in global demand, the Indian lead market has seen a slight decrease in demand on account of increased consumption of secondary lead and alternatives of lead materials. The automobile sector has shown tremendous growth. In CY 2023, the Indian automobile industry grew by 11% on a y-o-y basis.

Hindustan Zinc is the leading lead producer in India, with a market share of 64% in the primary market during FY 2023-24. We produce lead ingots with 99.99% purity, which are registered with LME. In FY 2023-24, 59% of our production was consumed by the domestic market and the rest was exported. We are expecting to increase our sales mix to 100% in the domestic market through new customer acquisitions and the development of lead applications.

Global lead supply is expected to increase by 1.1% in CY 2024, while demand is expected to rise by 1.8%. Lead usage in original equipment vehicle batteries is predicted to be 25% lower in CY 2024 from the CY 2017 figure, due to a decline in new internal combustion engine vehicle (ICEV) sales. The percentage of lead used in original equipment vehicle batteries has decreased from 16% to 11%, indicating the need for replacement in car batteries.

However, ICEVs are not losing market share to BEVs, as lithium-ion and lead-acid batteries can be used in SLI batteries for hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs). In FY 2024-25, Indian lead demand is expected to be around 190 kt, 6% lower than the previous year. The adoption of lead alternatives will take time globally, with the IRA (Inflation Reduction Act) in the USA, Fit for 55 programme in the EU, NEV (New Energy Vehicle) policy in China, and FAME II (Fast Adoption and Manufacturing of EV) in India providing a broad timeline for the transition from fossil fuel to electric power.

Hindustan Zinc has offered growth opportunities and global exposure that have helped me realise my true potential and boost my confidence. Working with leaders who actively involve you in decision-making processes and value your opinions is at the core of Hindustan Zinc’s culture