At Hindustan Zinc, we closely monitor the external industry and market environment to identify growth opportunities across our various business segments. Consistent monitoring of the evolving global and domestic trends helps us insulate ourselves against existing and emerging risks having the potential to impact our business. It equips us to capitalise on emerging opportunities to stay ahead of the market curve. The challenging global environment notwithstanding, the Indian economy stayed on the growth course during FY 2023-24, catalysing enhanced zinc and steel production, and showing promising projections for zinc applications and silver as a key commodity in electrification and railways & infra development. Hindustan Zinc has successfully positioned itself to capitalise on these opportunities and surge forward on its progressive journey.

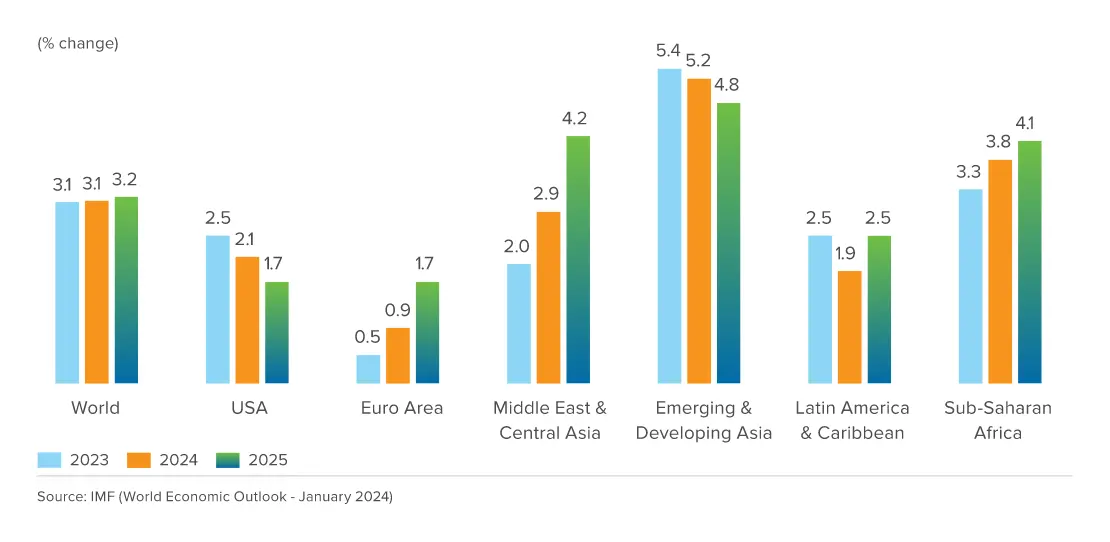

The World Economic Outlook (WEO) for January 2024 predicted 3.2% growth in CY 2025. At the same time, the forecast for CY 2024 improved due to China's fiscal support and the stronger than expected resilience in the US and in several large emerging markets and developing economies. However, a series of factors pushed down the projection for FY 2024-25 to below the historical (2000-19) average of 3.8%. These included high central bank policy rates to combat inflation, withdrawal of fiscal support due to excessive debt-burdening economic activity, and low underlying productivity growth. Most regions are seeing faster-than-expected inflation declines amid a tightening monetary policy and easing of the supply-side problems.

The projected decline in growth in the United States is expected to be 2.1% in CY 2024 and 1.7% in CY 2025, from 2.5% in CY 2023. This decline is attributed to the slowdown in aggregate demand, caused by the gradual tightening of fiscal and monetary policies, and labour market weakening.

The Euro area's growth rate is expected to rebound from its lower projection of 0.5% in CY 2023 to 0.9% in CY 2024 and 1.7% in CY 2025, on account of a comparatively high level of exposure to the conflict in Ukraine. The rebound is anticipated to be driven by stronger household consumption as the impacts of the energy price shock fade and inflation declines, supporting real income growth.

Due to the post Covid slowdown in China's economy and the slow pace of recovery in its manufacturing sector, growth in emerging and developing Asia is predicted to slow down, from an estimated 5.4% in CY 2023 to 5.2% in CY 2024 and 4.8% in CY 2025. The growth estimate for CY 2024 considers a higher government spending on boosting resilience to severe disasters. China's growth is expected to be 4.1% in CY 2025 and 4.6% in CY 2024.

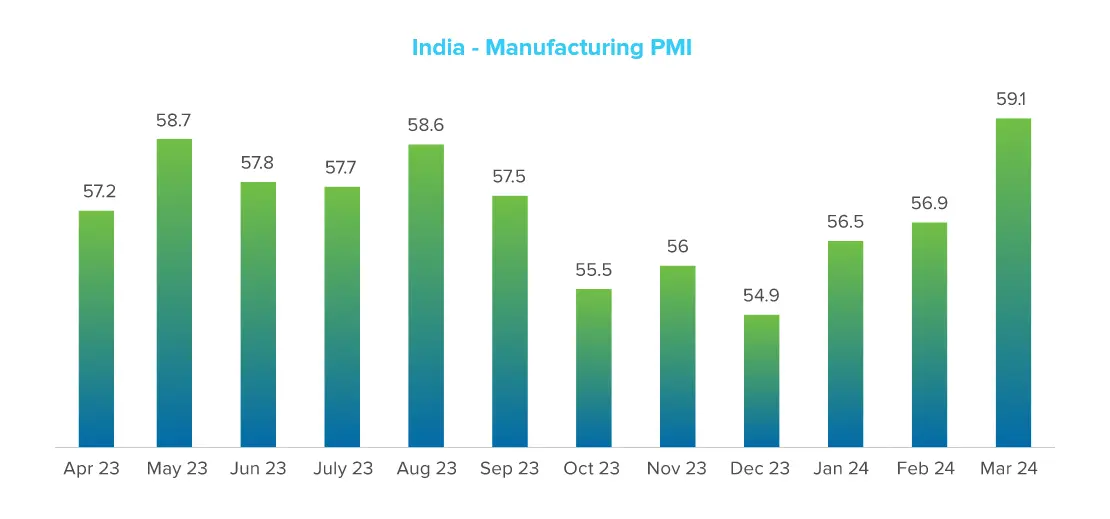

The Indian manufacturing industry has shown robust growth in FY 2023-24 on account of strong consumer demand and infrastructural growth. The year started with a healthy manufacturing Purchasing Managers’ Index (PMI) of 57.2 for the country, and this growth sustained till the end of the year, closing at a remarkable manufacturing PMI of 59.1.

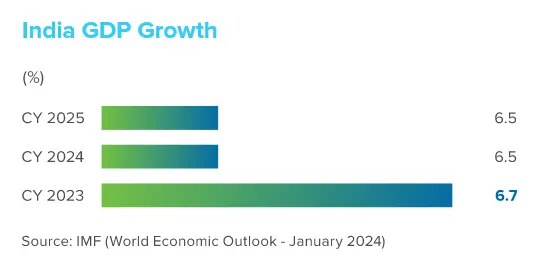

With regard to GDP, the growth in India is expected to stay robust at 6.5% in CY 2024 and CY 2025, according to January 2024 report of World Economic Outlook, indicating a strong domestic demand. This growth is basically influenced by consumer spending, government spending & investment, and net exports. Technological advancement, political stability and regulatory environment will play a pivotal role for future growth.